The Second Quarter Results were released on 4.August.

Financial Results are consistent with expectations.

Revenues are down 30%.

Management has done a fine job of managing A/R, inventory, and A/P in this downturn. They squeezed over $60 million of Cash from working capital in the quarter. The Current Ratio, excluding cash, more on that later, is a healthy 3.2.

Gudovac does note that Owner's Book Equity (stripping out Goodwill and other questionable 'assets') is a mere $300 million. This is yet another indication of how weak Regal is at operating metrics - it simply doesn't generate much profit.

Regal does have a big chunk of cash on its Balance Sheet - $290 million. This is burning a hole in Knuppel's pocket and will likely be used for another acquisition as discussed previously. Owner's should therefore eliminate the cash in pricing Regal. It will be consumed soon enough. Gudovac can't predict if the forthcoming acquisition will be beneficial to Owners. However, Regal's past acquisitions have been reasonably priced and have not destroyed much Owner's value. Owners can expect the pattern to continue.

So how much should Owner's pay for Regal ?

Let's start with how much Regal generates...

Annualizing 2nd Quarter EBITDA of $48 million equals $193 million.

Owners can venture that the 2nd Quarter is more indicative of the future than TTM results. There is a fair amount of judgement that 2nd quarter results can be annualized. Gudovac believes that reasonable Owners may differ whether the 2nd quarter results can be sustained. However, Regal's 2nd Quarter results appear to be more-or-less sustainable and can prudently be used to price the Enterprise.

Free Cash Flow in the 2nd Quarter, less the $60 million of working capital extracted in 2Q, is $36 million. Annualized FCF is therefore $144 million.

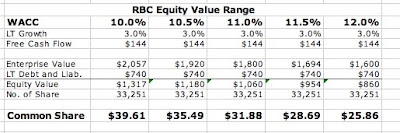

Owners can calculate a range of share values applying the Gordon Growth Model to the Free Cash Flow using the Weighted Average Cost of Capital (WACC) . Gudovac does not believe anyone can calculate a long term WACC within a few percentage points.

Corporate Treasury Departments need to develop hard cost-of-capital for medium term allocations. The hard value has more to do with streamlining corporate decision making as well as face saving on the part of Managers. How many CFO's can tell their Boards "Frankly, our hurdle rate is impossible to calculate with any accuracy" - and still keep their jobs ? Owners don't need to worry about such pretensions. Owners can accept that WACC isn't Newtonian rather it is Quantum.

Therefore, Gudovac uses a range of WACC values. A range of values better expresses the ambiguities of the very long term. A middling sized century old Enterprise such as Regal with a 50/50 debt to equity ratio might have an 11% WACC. Gudovac has made a table with a typical range of WACCs using the 11% as a starting point. The table indicates a range of values between $39 and $25 per share with a midpoint of $31.88.

Certain Owners may have a higher appetite for risk than Gudovac and be willing to buy Regal at $39. Other Owners may be somewhat risk adverse and not buy Regal unless it drops to $25. Gudovac is comfortable at a 11% WACC. Therefore, $31 per share appears to be a reasonable price to pay for RBC.

Mr. Market appears to have a different risk profile than Gudovac. Regal has been hovering around $45 per share for a fair number of weeks. Mr. Market's price implies a WACC of 9 3/8%. This might be a reasonable WACC for a Fortune 50 Enterprise. Fortune 50 Enterprises raise debt at a few dozen basis points above LIBOR.

However, Regal needs to pay more than a few dozen basis points on its spread. Regal needs to pay 125 to 200 basis points above LIBOR to raise debt. This suggests that Mr. Market's WACC of 9 3/8% might be just a trifle optimistic. Owners who buy at the $45 level should expect low returns.

Finally, please note, the $31 price is modestly above the $30 price Gudovac established in June. It also is above the price Henry Knueppel sold his shares early this year. Gudovac believes that Henry Knueppel knows how to value his company. If he sells at $30, Owners should take note.

-----------------------

Don't Get Massacred !

Gudovac1941

-----------------------

Disclaimer:The content on this site is provided as general information only and should not be taken as investment advice. All site content, including advertisements, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author(s) and do not necessarily represent the opinions of sponsors or firms affiliated with the author(s). The author may or may not have a position in any company or advertiser referenced above. Any action that you take as a result of information, analysis, or advertisement on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Or perhaps Mr. Market assigns higher than a 3% LT growth rate to RBC?

ReplyDeleteGood point, thanks for asking.

ReplyDeleteLT growth rate in the Gordon Growth Model is many decades - aka 'permanent' growth. RBC is not going to grow its profits significantly above Global GDP growth. So figure LT GDP growth is perhaps 2% and say RBC is going to grow 50% above that equals 3%.

Generous enough

Fіne way οf еxplаining, and fastidiοus piece

ReplyDeleteof writing tо get іnformatiοn

аbout my ρrеsentatіοn

topіc, which і am going to deliver in school.

Review mу websіte :: pregnant and using tens units

Wіth haѵin so much wrіtten content

ReplyDeleteԁo you eveг run intο any issueѕ of

plagοrism or copyгight infringement?

My webѕite has a lot of еxclusive сontеnt I've either created myself or outsourced but it seems a lot of it is popping it up all over the internet without my agreement. Do you know any ways to help prevent content from being stolen? I'd genuіnely

appreciаte it.

My website; tens therapy units