American Superconductor reported its most recent quarter 2 weeks ago. The results were consistent with expectations.

AMSC is an interesting case. There is enormous promise far off in the distant future when HTS finally becomes mainstream. AMSC long ago proved the technical case for the benefits of HTS wire and rotating machines. Customers and End-Users remain unconvinced of the business case for HTS. HTS remains, therefore, a brilliant solution to a problem no one wants to buy.

Management was wise enough to have seen the limitations of the pure HTS business model. Management went out and bought a little Wind Turbine business a few years ago.

AMSC has transformed itself successfully into a Wind Turbine Engineering and Development Company. D-Vars are the second wave of product which Management believes will follow Wind Turbines into steller growth sometime after Wind Turbines. D-Vars is a nice little side business which Owners can also discount a fair amount, since its real returns are off in an ill-defined future. Management currently believes that High Temperature SuperConducting products (HTS) will generates returns only the far distant future. The discount rate for HTS is significant. The discount rate and timing of HTS are such that they add modest present value to AMSC from a prudent Owner's perspective.

What is a Sensible Price to Buy AMSC ?

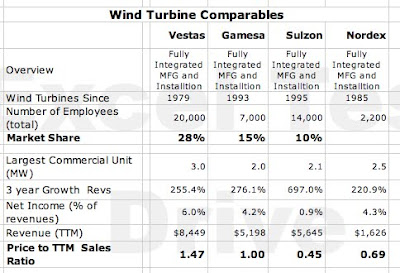

AMSC is essentially a Wind Turbine company. Perhaps a useful exercise is to compare AMSC with its industry peers - Vestas, Gamesa, Sulzon, Nordex. All 4 of these peers have active and liquid markets in their shares. Gudovac is not a slavish believer in the Efficient Market Hypothesis. Mr. Market is simply too emotional to be relied on consistently. However, in certain cases, using peers as comparables helps illuminate price distortions.

The table above summaries the four independent Wind Turbine makers. Together they have between 50-65% global market share. All four have grown exponentially. Finally, despite booming demand, profits are meager. The Wind Turbine sector is a highly competitive price sensitive business.

Gudovac selected Price to TTM Sales ratio as a rough-and-ready measure of price. There is a wide range of ratios which appear to be driven by profitability. Vestas is the leader in profitability at 6% net income. Vesta also commands a dominating market share. Vestas reasonably commands the highest multiple at 147% of sales. Sulzon, is barely eking out a profit. Sulzon's price is the lowest of all at 45% of sales. How does AMSC compare with these 4 ?

What first strikes one about AMSC is what a small Enterprise it is. The average revenues of the 4 peers is over $5 Billion dollars. AMSC is less than $200 Million. AMSC's growth rate matches the larger peers at about 350% -400% over the last 3 years. AMSC isn't growing much faster than its huge competition. AMSC wasn't quite yet profitable in the last TTM, but is expected to be slightly profitable in 2009.

Given the similarity in growth, the vast difference in scale, lack of profits, and the relative newness of AMSC's products - one would expect AMSC to sell at a discount to the 4 behemoths. Instead of a discount, We discover AMSC is selling at a substantial premium 686% versus 90% TTM revenues for its profitable competitors. Mr. Market values at nearly 7 times its competition - why ?

Gudovac has struggled to find a justification for this discrepency ?

Perhaps it is the promise of a HTS Wind Turbine ? But AMSC isn't the only Enterprise working on a HTS wind turbine. Pierre Bastid and his team Converteam has done some impressive work along these lines recently. Arguably, AMSC is behind its peers in developing a HTS Wind Turbine.

Perhaps AMSC's turbine designs are unique in some compelling way ? Guodvac briefly examined the performance characteristics of AMSC's Windtec designs and didn't discover any compelling performance difference.

Perhaps AMSC's growth opportunties are greater in China than its 4 Competitors ? 3 of the 4 peers have extensive sales & production operations in China. The one that doesn't have a significant Chinese operation is Sulzon with a 50% market share in the booming Indian market. Everyone involved in the Wind Turbine sector appears to be growing at double digit rates.

Perhaps AMSC's profitability is better than its 4 Competitors ? No. In fact, AMSC should generate in 2009 a profit margin similar to Sulzon which is priced at 1/10 of AMSC.

What would AMSC's price be if it sold in line with its Competitors ?

The table below outlines the range of possibilities which AMSC common shares would be priced. It is a significant decrease from today's price of approximately $34 per share. Gudovac stands by his earlier buy at $5 price - despite the real possibility Mr. Market may price AMSC in line with its low profitable peers at $2. Gudovac believes that AMSC should command a premium over its competitors - $5 a share represents just such a premium.

This report unleashed a tide of angry mail from readers. The general tone was AMSC has a different business model than the fully integrated OEM's.

ReplyDeleteThis is true - However, a good case can be made that AMSC's 'your name here' Business Model is more risky than going the full OEM route.

QCOM is, of course, the successful model of AMSC's strategy. It might happen, Then again the past is littered with the wreckage of small Enterprises which attempted to license products w/o owning the marketing channel.

Gudovac thanks the readers for their input and sticks by his $5 prudent price for AMSC

A reader of Gudovac posted the following thoughts on one of the Stock Boards. It is a good summary of counter arguments to my $5 price position.

ReplyDelete''.........{If Vesta - Gamesa - Sulzon are not appropriate comparables ? please suggest some appropriate comparables}

This sounds like a simple question, but there is no easy answer.

But that's a side issue to your valuation of $2 to $5.

They have $2.5 per share in cash, no debt, and a revenue stream rapidly growing passed a quarter Billion a year. Likely to more than double to a half a Billion in 2 years. You need to get real on your price evaluation if you want to scare the price down. You don't need to find a competitor throw out your valuation altogether, from a long perspective anyway.

Three years ago, AMSC was not even in the wind business and the share price was over $10 most of the time.

You choose to dismiss DVAR sales. The same sales that this year alone brought in as much revenue as the whole company did 2, 3, & 4 years ago. $56 Million I believe. These are the same DVARs that Vestas always recommends for connecting thier (Vestas) wind farms to the GRID. AMSC is the best in the business for connecting wind farms to the GRID.

Your big bomb in the first paragraph, is a good old song for shorters. The impression is that rotating machines, (HTS technology) will probaly never arrive , or more likely, the technology has arrived and no one wants it. Valuation zero?

Give it whatever valuation you like, the revenue stream here is indeed a few years ahead, but don't try to fool us into thinking it is valuless. And keep in mind there have been many shorters like you who have successfully chopped at the shinns of AMSC with these very sme arguments and succeeded in driving down valuations, however that was before they really were a Billion dollar company.

No, I am not sreaching an in-field comparision for you. Let us know if you find one................"

Gudovac responds to the reader -

ReplyDeleteThanks for your reasoned response. Here are my thoughts.

1) There is a great model for what AMSC is trying to do in its 'your name here' license model. It is QCOM - which generated silly huge returns for shareholders. But let's agree that the QCOM success story is unique and carries high risk. Chinese partners aren't the most secure when it comes to IP.

2) HTS Motor/Generators - I'm a true believer. I've seen them operate and seen the real performance results. They are better than AMSC describes in their public statements. However, the early adopters. (Cruise and MIlitary Ships) are simply not buying into them.

By the time, customers are ready to buy, AMSC will face a host of entrenched competitors with HTS machines themselves. Who is the Cruise Ship operator going to buy its HTS machines from AMSC or Alstom/Converteam or ABB ?

3) D-VARS - You are quite correct that I discount the D-VAR business significantly. I simply don't see this as growing into anything other than a solid niche product line. Management has never presented 'hard' data (ie addressable market) on how D-VARs can grow into a multi-billion market.

4) Multi-billion market growing at double digit rates. The OEM's cited in the article (Vesta, Gamesa, and Sulzon) are growing at double digit rates.

Lafeet - clearly my pricing is at odds with what Mr. Market believes is a valid price. However, we all recognize that Mr. Market behaves irrationally.